A Firm That is Losing Money Should Nevertheless Choose to Continue Operating if Its

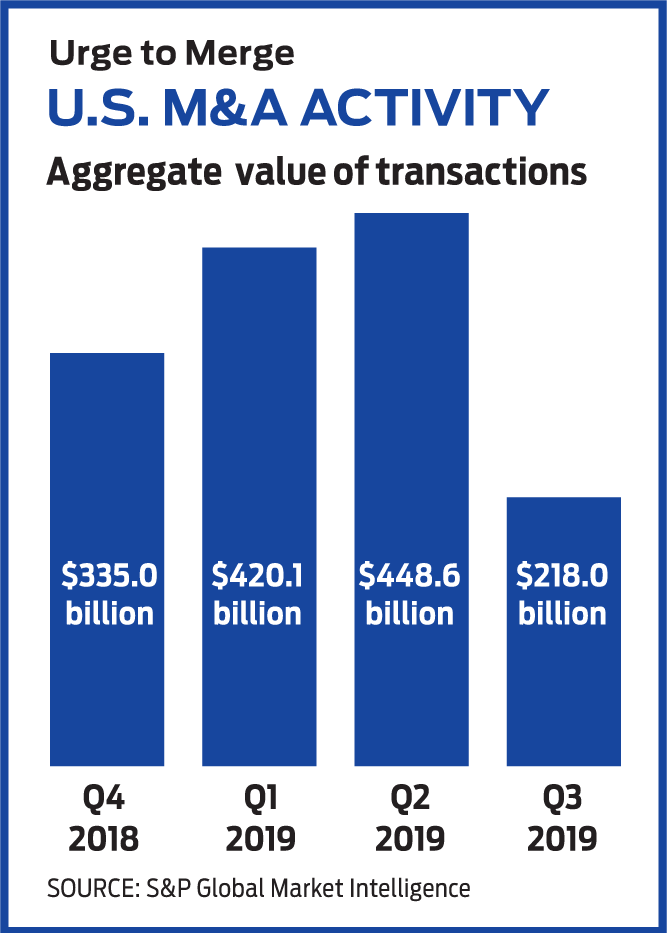

Wall Street has long been known for deal-making. But after a brisk first half of this year, the pace and value of deals has slowed considerably. Mergers and acquisitions announced in the third quarter of 2019 totaled $218 billion, down from $449 billion in the second quarter, according to research firm S&P Global Market Intelligence. Despite the slowdown, more than 10,000 deals were announced for the year through September 30, valued by S&P Global at nearly $1.1 trillion

It was hard to ignore Occidental Petroleum Corp.'s dramatic courtship of Anadarko, ending in August in an acquisition that S&P Global valued at $57.2 billion. Other big deals announced this year include Bristol-Myers Squibb's pending acquisition of Celgene, which S&P Global calculates is worth a whopping $95 billion, and United Technologies' proposed merger with Raytheon, valued at $91.1 billion. The prospects are good for more M&A, says S&P. Lower interest rates are keeping acquisition financing costs down, and although a rising stock market can make takeover targets more expensive, it can also boost buying power in cash-and-stock deals.

How to invest. The fastest way to benefit from a hot M&A market is to own stock in a takeover target. Investment firm Fidelity estimates that a target's stock typically increases 30% by the time the deal closes. But trying to predict a purchase before it happens is like trying to find hay in a needlestack.

Subscribe to Kiplinger's Personal Finance

Be a smarter, better informed investor.

Save up to 74%

Sign up for Kiplinger's Free E-Newsletters

Profit and prosper with the best of Kiplinger's expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of Kiplinger's expert advice - straight to your e-mail.

Instead, consider a merger arbitrage fund. After news of a sale goes public, these funds pick up stock of the company being acquired in hopes that they'll profit on the difference between the current share price and the price when the deal closes—if it closes.

M&A.final.1.indd

(Image credit: Getty Images)

The odds of a deal falling through are slim, but the risk is real. By the time a proposed merger between Pfizer and Allergan fell apart in April 2016, Allergan's stock price had fallen by nearly 20% from where it stood when the deal was announced and by more than 30% from the proposed takeover price. "The downsides in this industry are steep," says Roy Behren, comanager of Merger Fund (symbol MERFX (opens in new tab)). "When it comes to fund performance, it's not the deals you are in, it's the deals you avoid," he says.

Behren and comanager Mike Shannon have managed the fund, with more than $3 billion in assets, since 2007 and have a solid track record of picking winning deals. In the past 10 years, the fund has returned an annualized 3.1%—above average for market-neutral funds—with below-average volatility. "People invest with us because they want absolute, stable returns," says Behren. Consider that Merger lost a cumulative 5.0% in the 2007–09 bear market, compared with 55.3% for the broad market. The 2.01% expense ratio seems steep, but it compares favorably with other market-neutral funds.

Merger arbitrage exchange-traded funds follow a similar playbook but typically have lower fees and broader criteria for stock selection—which can increase risk. The IQ Merger Arbitrage ETF (MNA (opens in new tab), $32), with just under $1 billion in assets, charges 0.77% in expenses. The fund invests in takeover targets headquartered in developed markets, focusing on firms that have profit margins exceeding a certain threshold and whose shares are highly liquid. The ETF won't hold a stock for more than 360 days, says manager Sal Bruno. MNA has returned 2.8% annualized since it launched in late 2009.

It's possible to profit with the companies doing the acquiring—if you know where to look. Health care equipment firm Danaher (DHR (opens in new tab), $144) follows an aggressive growth-through-acquisition strategy, but it keeps sprawl in check by cutting costs and overhauling its acquisitions. "Danaher's strength is targeting a bloated company in a strong industry and whipping it into shape," says Mike Bailey, director of research at FBB Capital Partners (opens in new tab). The stock has returned 34% over the past year and 19% annualized over the past 10 years. It currently trades at a price-earnings ratio of 27, compared with 17 for the market overall, so look to buy on dips.

Source: https://www.kiplinger.com/article/investing/t052-c000-s002-how-to-cash-in-when-firms-merge.html

0 Response to "A Firm That is Losing Money Should Nevertheless Choose to Continue Operating if Its"

Post a Comment